reit dividend tax malaysia

REITs tend to pay out steady incomes similar to dividends which are derived from existing rents paid by tenants who occupy the REITs properties. This is a final tax and there is no need to declare this in the personal tax return of the unit holders.

TTM Dividend Yield.

. However unit holders are liable to tax on the distribution of income. If a tax treaty reduces the withholding rate on interest paid to a nonresident 15 is withheld from the amount paid. Is REIT Dividend Taxable In Malaysia.

Even if a REIT is exempt from tax by distributing at least 90 of its total income during the year the. Market Trading Participation Statistics. REITs by the Capital Markets and Services Act 2007 for listing on Bursa Malaysia.

2 more Malaysia-listed ETFs that pay decent dividends. The taxation of dividends in Malaysia is subject to a single-tier system and those dividend payments made by companies under this system are not subject to tax. The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors.

AXREIT I would not buy this 5 reits now because the Dividend Yield DY are the lowest as well from 469 to 524 before deducting the 10 tax. As for dividend withholding tax Malaysia doesnt charge it. Refer to the first pictures 1.

If a Real Estate Investment Trusts fund distributed at least 90 percent of their total yearly income to unit holders the REIT itself is exempted from tax for that year of assessment. Since the income distributed by REITs are tax exempt no tax credit under subsection 110 9A of the Income Tax Act ITA 1967. It is hope that the reduced withholding tax of 10 will be extended if not further reduced as in NIL withholding tax in Singapore in coming Budget 2011.

Axis REIT Managers Berhad Penthouse Menara Axis No. This means that most REITs pay out at least 100 of their taxable income to shareholders. REITPTF level-subject to tax 2000-not subject to tax REITPTF 10000 -not subject to tax REITPTF 14000 Distribution from REITPTF Distribution from REITPTF Year 2 RM Year 1 RM 3.

Taxation of unit holders of REITs. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate investors including resident and non-resident inviduals.

3 Years Continuous Growing. The withholding tax rate for individuals is 10. Dividend income Malaysia is under the single-tier tax system.

Another thing that you need to know about TradePlus MSCI Asia ex-Japan REITs Tracker. Real Estate Investment Trusts. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate investors including resident and non-resident inviduals.

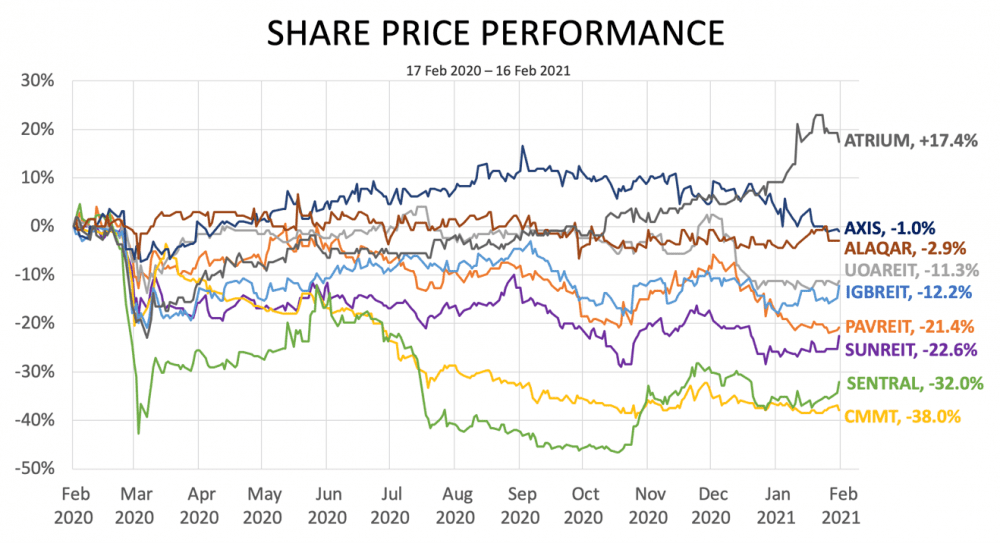

Yahoo Google Bursa Web TradingView. Meanwhile on Malaysian REITs still commanding attractive yields Yap says the high-yielding and Covid-19-resilient office REITS offer better interim gains via dividend yield compression. The top 5 market capitalisation of REITS in Malaysia 1.

In a case where dividend income forms part of the total income distributed to unit holders the tax credit from tax at source is given to the REITPTF and the tax computation at REITPTF and. It is hope that the reduced withholding tax of 10 will be extended if not further reduced as in NIL withholding tax in Singapore in coming Budget 2011. All REITs seeking listing on Bursa Malaysia will require Securities Commissions approval under Section.

19 rows Dividend Ranking. 2 Jalan 51A223 46100 Petaling Jaya Selangor Darul Ehsan Malaysia. The REIT can then deduct all of those dividends that it paid to shareholders from its corporate taxable income.

Dividends are exempt in the hands of shareholders. According to this regime the corporate income tax imposed on a companys profits is in the form of a final tax and the distributed dividends are exempt from tax in the hands of the shareholders. To qualify as a REIT the company must have at least 90 of its taxable income distributed to shareholders annually in the form of dividends.

Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. However in the long run she continues to prefer the retail segment particularly prime or niche malls for their proven business resilience. 48 rows YTL HOSPITALITY REIT.

ETF 2 MyETF MSCI Malaysia Islamic Dividend MyETF-MMID0824EA ETF 3 Principal FTSE ASEAN 40 Malaysia ETF CIMBA400822EA No Money Lahs Verdict. YTL Hospitality REIT the Trust is an income and growth type fund. What about the top 5 Dividend Yield REITS.

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

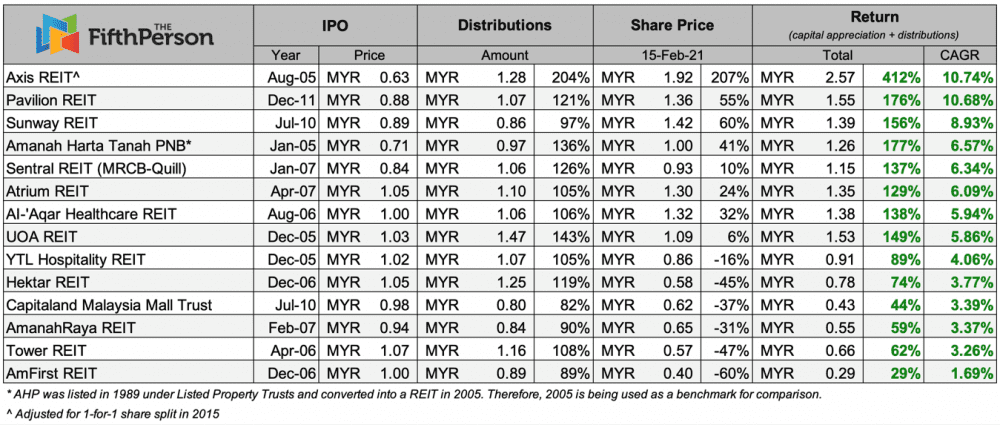

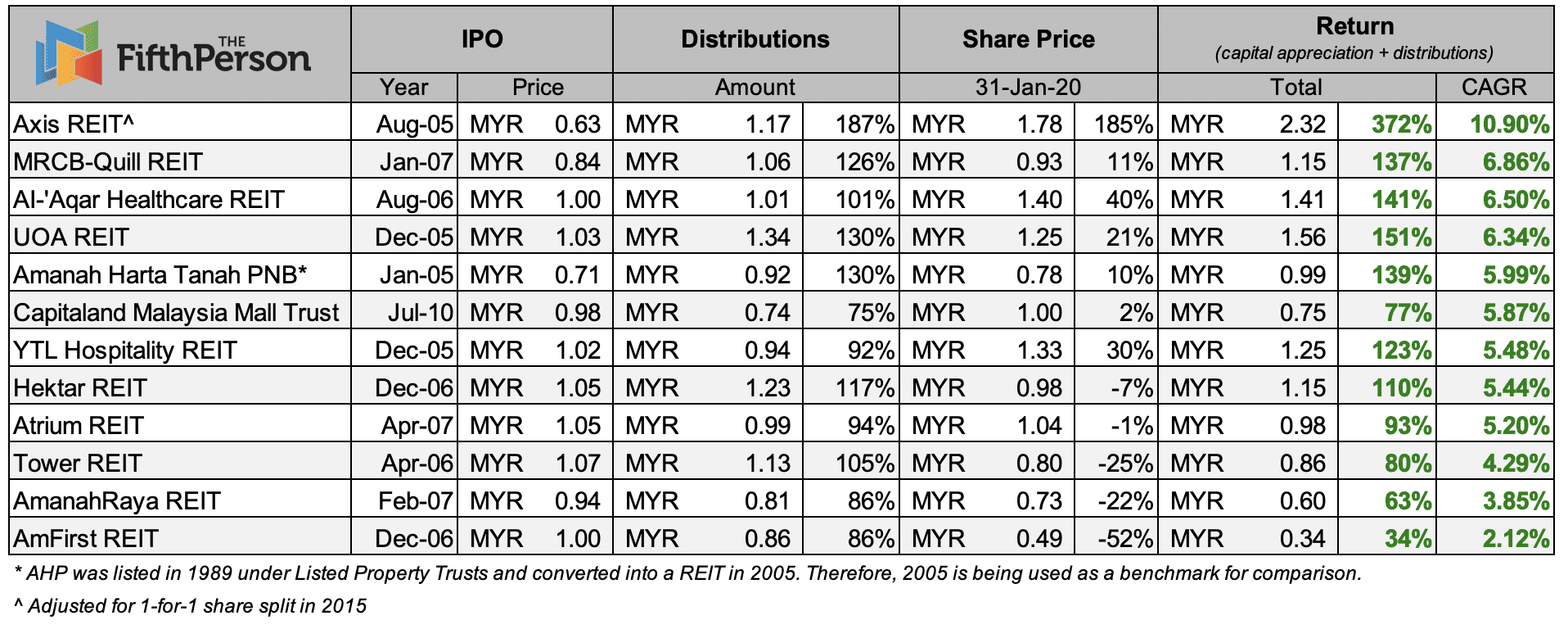

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Finance Malaysia Blogspot Understanding Reits

Nav And Dpu Of Ireits In Malaysia Download Scientific Diagram

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

The Complete Guide To Reits In Malaysia Your Real Estate Partner

Reits Listed On Bursa Malaysia As At March 2016 Download Scientific Diagram

The Ultimate Guide To Investing In Reits In Malaysia The World Bizweek

How Are Individual Reit Holders Taxed

A Complete Guide To Reits Malaysia Real Estate Investment Trusts Youtube

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Etf Portfolios Investing Real Estate Investment Trust Trading